Compare Credit Cards

Enjoy low rates, no annual fees, no balance transfer fee, and no cash advance fee. Whether you are looking for a credit card with rewards, or a card with a low rate to make it easier to pay off your balance, we’ve got you covered with an Honor Select Credit Card, or Honor Select Rewards credit card!

Credit Cards For Your Lifestyle

Choosing the right credit card can is a game-changer in managing your finances. Whether you’re looking to build your credit score or earn rewards on everyday purchases, our range of credit cards has you covered. With no annual fees, flexible payment options, and seamless integration with your favorite digital wallets, it’s never been easier to find a card that fits your lifestyle.

Select

Credit Card

The perfect card for balance transfers and building credit.

as low as

12.74% APR*

- Low Rate Credit Card

- No Annual Fee

- No Cash Advance Fee

- No Balance Transfer Fee

Select Rewards

Credit Card

Ideal for shoppers looking to earn rewards and cash back.

as low as

16.74% APR*

- Earn 2 reward points per $1 spent

- Redeem points for cash

- back, travel, and more**

- No Annual Fee, Cash Advance Fee, or Balance Transfer Fee

*APR = Annual Percentage Rate.

**Transactions associated with gambling, sports betting and/or gaming purchases not eligible to accrue reward points.

How To Redeem Select Rewards Points

Our uChoose Rewards program offers our Select Rewards credit cardholders the best-in-class rewards options, including 2% cash back, travel, merchandise, gift cards, and much more!

Register Your Card

Creating a uChoose Rewards account is simple! It’s an easy 3-step registration process and only takes a few minutes. You will need:

- 16-Digit Card Number

- Personal Information

- Account Information

You can access the uChoose Rewards system through the Honor mobile app or online banking

Cash in Your Points

You can access the uChoose Rewards system through CardHub on the Honor mobile app or online banking.

- You will be required to create a uChoose Rewards account the first time you redeem points.

- Reward points can be redeemed for up to three years following the transaction date.

Contactless Payments

All Honor credit cards and debit cards issued on or after October 1, 2023 are enabled with contactless technology and will display the contactless symbol. A contactless-enabled card allows you to tap your card on the payment terminal to complete a purchase versus inserting or swiping it as commonly done in the past. Not only is this a more convenient and quicker touch-free payment method, but it is also more secure.

What you need to get started

-

To process a contactless payment, simply:

- LOOK for the contactless symbol on the payment terminal.

- TAP or HOLD your contactless-enabled card close to the payment screen.

- If contactless payments aren't enabled at checkout, you can still use your card by swiping or inserting it as you previously would.

- The contactless payment method is secure because it generates unique data for each transaction.

Balance Transfer

Credit card debt can be overwhelming, but Honor is here to help. Our easy balance transfer option moves your debt to a low-rate Honor credit card, making it easier to pay off faster and with less stress. Let’s take control of your finances and brighten your future together!

What you need to get started

- An Honor Membership

- An Honor Select or Select Rewards credit card

- The balance information for the credit card(s) you’d like to transfer

Simply fill out a quick, secure online form, and a dedicated Honor team member will contact you to guide you through the rest of the process.

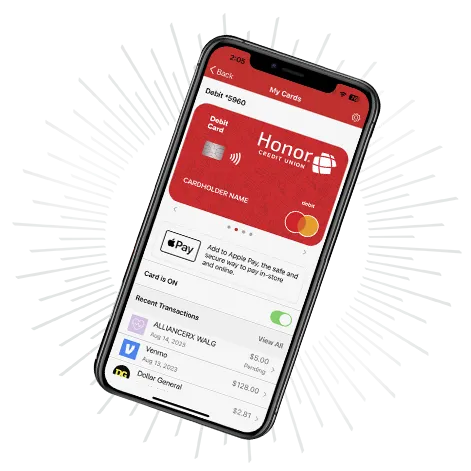

CardHub Card Management

Take charge of your cards like never before with the CardHub feature in the Honor mobile app! CardHub lets you instantly turn your cards on or off for added security, receive real-time alerts for every transaction, redeem credit card reward points with ease, and access detailed spending insights to keep your finances on track. It’s the ultimate tool for control, convenience, and peace of mind.

Real-Time Alerts

Receive real-time mobile app alerts or email notifications every time your card is used.

Reset Your Pin

Within CardHub, you can easily reset your pin to keep your account safe and secure.

Turn Cards On/Off

You’re in control! Quickly and easily immediately turn your card(s) on/off with just the swipe of your finger.

Manage Travel Plans

If you’re travelling out of state or internationally, notify us within CardHub to make sure your card(s) are not restricted during your trip.

Redeem Reward Points

Members with reward-eligible credit cards can redeem reward points without the need to enter separate username/password.

View Spending Insights

Develop healthier spending habits or simply keep track of card usage by quickly seeing how, when and where you spend.

How To Enable Card Control

Enrollment only takes a few minutes using the mobile app or online banking portal.

- Mobile App – CardHub, also known as “Manage My Cards,” can be found under the “More” menu or the sub-menu of any active checking account or credit card.

- Online Banking CardHub, also known as “Manage My Cards,” can be found under the “Member Services” menu at the top of your screen.

Card Support

Take charge of your cards like never before with the CardHub feature in the Honor mobile app! CardHub lets you instantly turn your cards on or off for added security, receive real-time alerts for every transaction, redeem credit card reward points with ease, and access detailed spending insights to keep your finances on track. It’s the ultimate tool for control, convenience, and peace of mind.

Important numbers

- Lost or Stolen Credit Card 833.933.1681 (domestic or international, collect calls accepted)

- CU*Talk Voice Banking 866.267.4348

- Credit Card Activation 833.933.1681

Travel Information

- If you're planning an international trip, keep us informed by stopping by a branch or giving our contact center a call at 800.442.2800 to let us know to expect transactions from your destination.

- Be aware of blocked or sanctioned countries. For an updated list, check the US Department of Treasury’s Office of Foreign Asset Control (OFAC). If you're visiting a country on the list, all card activity will be blocked. Honor Credit Union may also block additional countries, which will be listed here

Fraud Protection

- If you suspect fraud you can turn your card off instantly from within the Honor mobile app.

- Honor debit and credit card holders are automatically enrolled in our free card protection program. Cardholders can sign up for additional free MasterCard fraud services.

- If we suspect fraudulent activity, the transaction will likely be declined and your account will be blocked to prevent further harmful activity. We will attempt to notify you as quickly as 30 seconds after a suspicious transaction takes place.

Digital Wallet

Shopping has never been easier with solutions like Apple Pay™, Google Pay™, and Samsung Pay™. There’s no reason to lug around a thick wallet or big purse with credit cards and debit cards. Simplify your life by making your purchases with the touch of your finger by connecting your Honor debit card to your phone today.

Add Your Card to Your Phone

No Fees!

While many banks charge 3-5% for balance transfers, we don’t! Plus, Honor credit cards have no annual fees and no cash advance fees—helping you keep more of your money.

Faster Payoff

With no balance transfer or annual fees and low rates, Honor helps you pay off your balance faster.

One-on-One Help

If you’re new or need extra help, we’ll guide you through the balance transfer process to find the best solution!

Reloadable & Gift Cards

What do you get the person who has everything? A gift card or a Reloadable Travel Card might be the perfect simple gift you’re looking for. Our gift cards are like regular credit cards because they are accepted pretty much anywhere, and will be the one gift you know you won’t ever get returned! Stop by any local Honor branch to setup a reloadable card or to purchase a gift card.

Gift Cards

- Enjoy the convenience of spending money when and where you want to

- Can be used anywhere credit cards are accepted

- Can be loaded in amounts from $10 to $1,000

- Card will expire no sooner than five years from the date of issue

Reloadable Travel Cards

- Can be used anywhere credit cards are accepted

- Reload your card at any branch, or online at www.gocardservices.com*

- Can be loaded in amounts of $10 to $5,000

- 24/7 live operator support, lost and stolen card reporting services, and cardholder inquiry services

*Reloading and inactivity fees apply. See all fees on our Disclosures page.

More to Explore

To better help you understand credit, and credit cards, we’ve put together some helpful blog posts about credit cards, spending habits, and balance transfers.

4 Simple Ways to Keep Your Home Network Safe

Think of your network as the front door to your digital home. With a little care, you can keep it locked, safe, and secure for you and your family.

2 Rewards Cards to Keep ‘Top of Wallet’ in 2025

Learn if a credit or debit card is the best option for your wallet.

Unlock Holiday Savings with Honor

When you’re Christmas shopping you can earn double cash back with Select Rewards Credit Card, build your savings while you shop, track spending with MoneyMap, and more!

Take Control of Your Debt with a Credit Card Balance Transfer

Imagine consolidating your debt into one manageable payment. Here’s everything you need to know about credit card balance transfers.

Credit Card FAQs

Via The Honor App

Viewing and redeeming points through the Honor App is simple and easy!

- Log in to your Honor account on the Honor app

- Tap your Select Rewards account

- Tap “Redeem Points” and follow the prompts on the screen

- It’s that easy. From here, redeem your earned points for cash back, travel, gift cards, experiences & much more!

We have flexible options like share secured cards to help you start building credit and we offer smaller limits to get you started.

A variable interest rate is an interest rate that fluctuates over time because it is based on an underlying benchmark (Prime) interest rate that changes periodically.

You can earn 2 points for every $1 you spend with your Select Rewards Credit Card. Rewards include cash back, statement credits, gift cards, experiences, merchandise, charitable donations and more!

Please Note: Transactions associated with gambling, sports betting and/or gaming purchases not eligible to accrue reward points.

Please call us at 800.442.2800.

Stop by any local Honor branch or give us a call at 800.442.2800 to talk about your options.

Yes. Just be aware of the following guidelines:

- Simply give us a heads up before you leave by calling us at 800.442.2800 or stop by a local Honor member center so we know to expect transactions from your destination.

- Beware of blocked and sanctioned countries. Click here for a current list of those countries from the Office of Foreign Asset Control (OFAC) of the US Department of Treasury. If the country you are visiting is on this list, ALL card activity will be blocked per the requirement from OFAC. On occasion, Honor Credit Union may block countries in addition to those listed on the OFAC list, but should there be additional countries, they would be listed here.

- While debit and credit cards are accepted in most countries, MasterCard charges foreign currency conversion fees for purchases made with their credit and debit cards, in addition to ATM cash withdrawal fees.

^APY = Annual Percentage Yield, 0.00% APY. $250 paid when new or existing member without a current checking account opens a personal checking account with a minimum opening deposit of $25, sets up qualifying direct deposit(s) totaling $500 or more and conducts 8+ debit card transactions all within 60 days of account opening. A qualifying direct deposit is defined as one from a recurring paycheck, pension, or government benefits (such as social security) payments only. Non-payroll related ACH, person-to-person payments and transfers from other financial institutions or other Honor CU accounts do not qualify. Bonus will be paid within 30 days of minimum requirements being met. New account must remain open and maintain a positive balance for at least 90 days. If criteria is not met, $250 bonus will be withdrawn from account. New members must open account at honorcu.com/bonus/ or a local branch location. Existing members must open new checking account at branch location, phone, or video appointment, and specifically mention the $250 offer at time of opening. Existing members that have closed a checking account at Honor in last five years, not eligible. Offer subject to change without notice. The value of the reward may be reported on the appropriate Internal Revenue Service (IRS) forms and may be considered taxable income to you. Please consult your tax advisor regarding your specific situation. Insured By NCUA.