Card Features and benefits

We’re committed to making your life easier, and our debit card helps with that. With an Honor MasterCard Debit Card you have access to over 30,000 surcharge-free ATMs, you can pay by tapping your card with secure chip technology. You can receive instant alert notifications and manage your cards with CardHub in the mobile app and online banking.

Use Your Card How You Want To

ATM Video

Tellers

CardHub Card

Management

Debit Card

Roundup

Find a Surcharge-Free ATM

Need cash now? Visit one of our local branch, use any of our community ATMs listed below, or click the link to find a surcharge-free ATM near you through the CO-OP Network today!

community ATMS

- Battle Creek: VA Medical Center, 5500 Armstrong Road

- Benton Harbor: Pri-Mart Citgo, I-94 Exit 29 at Pipestone Road

- Buchanan: Country Heritage Credit Union, 16580 Bakertown Road

- Stevensville: Watermark Brewing Company, 5781 St. Joseph Ave

CO-OP ATMs

The CO-OP Network is a nationwide network of over 30,000 surcharge-free ATMs, offering credit union members easy access to their funds without extra fees. With ATMs located in retail stores, credit unions, and other convenient locations, you can withdraw cash and manage your account wherever you go, whether at home or traveling.

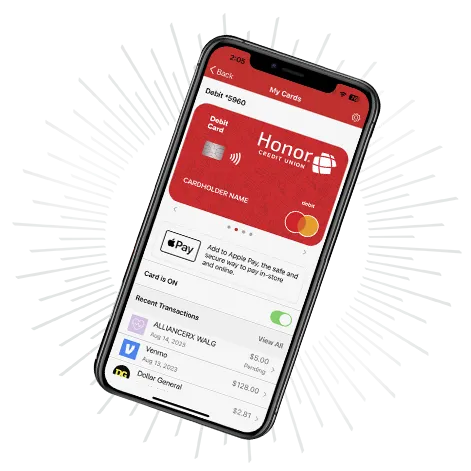

CardHub Card Management

With the CardHub feature in the Honor mobile app, you are in control of your cards and the activity on your cards. From the ability to turn your cards on and off, receiving real-time transaction alerts, to redeeming credit card reward points and viewing spending insights, CardHub is a feature worth using!

Real-Time Alerts

Within CardHub, you can easily Receive real-time mobile app alerts or email notifications every time your card is used.

Reset Your Pin

Within CardHub, you can easily reset your pin to keep your account safe and secure.

Turn Your Card(s) On/Off

You’re in control! Quickly and easily immediately turn your card(s) on/off with just the swipe of your finger.

Manage Travel Plans

If you’re travelling out of state or internationally, notify us within CardHub to make sure your card(s) are not restricted during your trip.

Redeem Reward Points

Members with reward-eligible credit cards can redeem reward points without the need to enter separate username/password.

View Spending Insights

Develop healthier spending habits or simply keep track of card usage by quickly seeing how, when and where you spend.

How To Enable Card Control

Enrollment is easy and only takes a few minutes and can be done within the mobile app or online banking:

- Mobile App - CardHub, also known as "Manage My Cards," can be found under the "More" menu or the sub-menu of any active checking account or credit card.

- Online Banking - CardHub, also known as "Manage My Cards," can be found under the "Member Services" menu at the top of your screen.

ATM + Video Tellers

Our ATM Video Teller machines allow us to provide face-to-face service for our members through the use of video technology. An Honor Team Member will help you conduct any of the financial transactions that you’re used to performing through the drive-thru, right through the machine. An added bonus is these machines function like a regular ATM 24/7!

Find An ATM Video Teller

We are constantly adding ATM Video Teller machines to our branch across Michigan. To find one near you, click the button below.

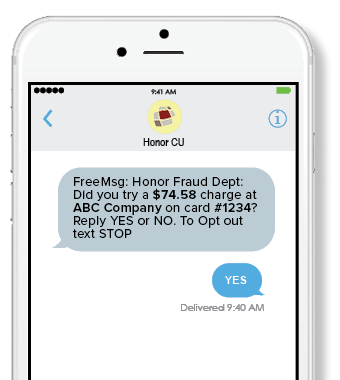

Text & Call Alerts

To help protect your money, when fraudulent activity is suspected with a card, no matter if it’s your credit card or debit card, your transaction may be declined (some lower risk transactions might go through).

How We'll Reach Out

- Text Message – You’ll receive free text alerts 24/7 anytime possible fraud is identified. If you recognize the transaction and authorize it reply “YES”, otherwise reply “NO.”*

- Voice Message – When your primary contact number is a landline, you’ll receive voice call alerts between 9 AM and 9 PM in your time zone. You’ll be prompted to answer questions during the call to confirm the transaction or you will be transferred to a representative if the transaction was not recognized.

- Email – If we cannot reach you after several attempts, an email will be sent to the address on file explaining why your card was blocked.

* SMS/Text is free to members with mobile service through Verizon, AT&T, or Sprint. Other usage costs may apply based on your mobile carrier.

Card Support

Important numbers

- CU*Talk Voice Banking

-

Debit & Credit Cards

- Card Activation: 800.992.3808

- Lost or stolen card: 833.933.1681

travel information

- If you're planning an international trip, keep us informed by stopping by a branch or giving our Contact Center a call at 800.442.2800 to let us know to expect transactions from your destination.

- Be aware of blocked or sanctioned countries. For an updated list, check the US Department of Treasury’s Office of Foreign Asset Control (OFAC). If you're visiting a country on the list, all card activity will be blocked. Honor Credit Union may also block additional countries, which will be listed here

fraud protection

- If you suspect fraud you can turn your card off instantly from within the Honor mobile app.

- Honor debit and credit card holders are automatically enrolled in our free card protection program. Cardholders can sign up for additional free MasterCard fraud services.

- If we suspect fraudulent activity, the transaction will likely be declined and your account will be blocked to prevent further harmful activity. We will attempt to notify you as quickly as 30 seconds after a suspicious transaction takes place.

- If fraud is suspected, you will receive a text and email notification inquiring about charges on your card. Please confirm or deny these charges by responding Yes or No. To speak with someone directly about suspicious card activity, call 833.763.2031 or 833.763.2033

Debit Card Round up

Our Debit Card Round Up program, formerly known as “It’s Your Change,” allows you to easily save money. Each debit card purchase will automatically round up to the nearest dollar, and the remaining change will be deposited into your savings account. Just like putting your pennies and dimes in a jar, you’ll be surprised at how much you can save without even thinking about it!

How It Works

- Debit Card Round Up is free and available to any member with a checking account and an active debit card.

- With Debit Card Round Up, each debit card transaction is automatically rounded up to the nearest dollar and the change is deposited into an account of your choosing.

- Funds can be deposited into your main savings account, a money market, or create a separate savings account and watch those dimes and nickels add up!

How To Enroll

Members can enroll in online banking or the mobile app 24/7. You can also call us at 800.442.2800 or stop by any branch.

- Log in to online banking

- In the Member Services menu tab select Debit Card Round Up

- Select the eligible checking account you would like to enroll

- Choose the option “I would like to round up purchases on my debit card for this account”

- Select which savings account you would like the amount to be deposited into and click Update

- Log in to the Honor mobile app

- Tap More on the bottom right

- Scroll down and tap Debit Card Round Up

- Select the eligible checking account you would like to enroll

- Choose the option “I would like to round up purchases on my debit card for this account”

- Select which savings account you would like the amount to be deposited into and click Update

Digital Wallet

Shopping has never been easier with solutions like Apple Pay™, Google Pay™, and Samsung Pay™. There’s no reason to lug around a thick wallet or big purse with credit cards and debit cards. Simplify your life by making your purchases with the touch of your finger by connecting your Honor debit card to your phone today.

Add It To Your Phone

- Apple Pay – Use your eligible iPhone, Apple Watch, or iPad to conveniently make purchases at participating merchants.

- Google Pay – Android users can use their phone to make payments at more than one million stores across the United States.

- Samsung Pay – Members with eligible Samsung phones can make payments to earn reward points redeemable for instant-win opportunities and other deals.

Instant Deposit

If you have a pending direct deposit that you need to access sooner, you can now access your paycheck before payday with Honor’s Instant Deposit feature! As soon as you see your direct deposit pending within online banking, or on the mobile app, you can access those funds!

Details

An instant deposit³ is defined as early access to a direct deposit that is scheduled to post to your account. An instant deposit is a way for you to gain access to your funds sooner.

- No checking account required

- Many employers post direct deposit funds 1-2 days early

- $10 early access fee per instant deposit

- There is no fee for a normal ACH direct deposit

How To Request An Instant Deposit

You can request an instant deposit within your online banking, in the Honor app, or by calling 800.442.2800. Follow the steps below for online banking and the mobile app.

- Log in to online banking

- In the My Accounts tab select ACH Transactions

- Select the ACH transaction you wish to instantly deposit and click Post Now

4. Confirm your instant deposit request and select an account to have the $10 fee drawn from

- Log in to the Honor mobile app

- Tap Accounts on the bottom menu, and then tap My Accounts

- Tap ACH Transactions

- Select the ACH transaction you wish to instantly deposit and tap Post Now

5. Confirm your instant deposit request and select an account to have the $10 fee drawn from

³$10 fee per instant deposit to gain early access to funds. No checking account required. Direct Deposit and earlier availability of funds are subject to the timing of payer’s funding, and credit union approval. Honor Credit Union cannot guarantee a payer’s funds will be available for instant deposit. Requests per each Direct Deposit must be made within online banking or by contacting the credit union. Insured By NCUA.

Overdraft Protection

An overdraft occurs when you do not have enough available funds in your checking account to cover a transaction. We understand life happens, and everyone can sometimes make a mistake or encounter financial challenges, so we have overdraft protection options to assist you in these situations.

What Your Options Are

- You can set up automatic transfers from another account, such as a savings account or money market, to cover your overdraft.

- You can set up automatic transfers from a line of credit or credit card to cover your overdraft.

- Learn how Courtesy Pay could help cover an overdraft if you do not have an automatic transfer set up.

- Learn how an NSF (Non-Sufficient Funds) might occur when you don't have an automatic transfer or Courtesy Pay set up.

Debit Card FAQs

It really is up to you, because both debit and credit will take the money out of your account right away. But, if you have a Benefits checking account, you will want to swipe your card as credit at least 12 times per month to help meet the requirements to earn your interest!

Yes. Just be aware of the following guidelines:

- Simply give us a heads up before you leave by calling us at 800.442.2800 or stop by a local Honor branch so we know to expect transactions from your destination.

- Beware of blocked and sanctioned countries. Here is a current list of those countries from the Office of Foreign Asset Control (OFAC) of the US Department of Treasury. If the country you are visiting is on this list, ALL card activity will be blocked per the requirement from OFAC. On occasion, Honor Credit Union may block countries in addition to those listed on the OFAC list, but should there be additional countries, they would be listed here.

- While debit and credit cards are accepted in most countries, MasterCard charges foreign currency conversion fees for purchases made with their credit and debit cards, in addition to ATM cash withdrawal fees.

Yes! Most Honor branches have the ability to instantly print a new or replacement card within minutes.

Yes. In most cases your checking and savings are both connected to your debit card. If you aren’t sure, give us a call or stop by a branch. Just remember, all Honor savings accounts are limited to six free withdrawals per month.