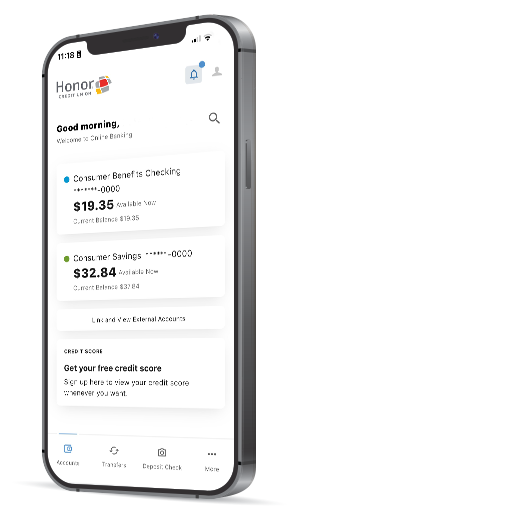

Online Banking

Bank from anywhere, anytime. With Honor Online Banking, you can view balances, transfer funds, pay bills, and track transactions securely and quickly, all on your terms.

Online Banking Features

Free online banking brings the branch to you! Whether it’s transferring money, paying bills, or even opening a new account, it all can be done from the comfort of wherever you are, whenever! Explore all the convenient features below.

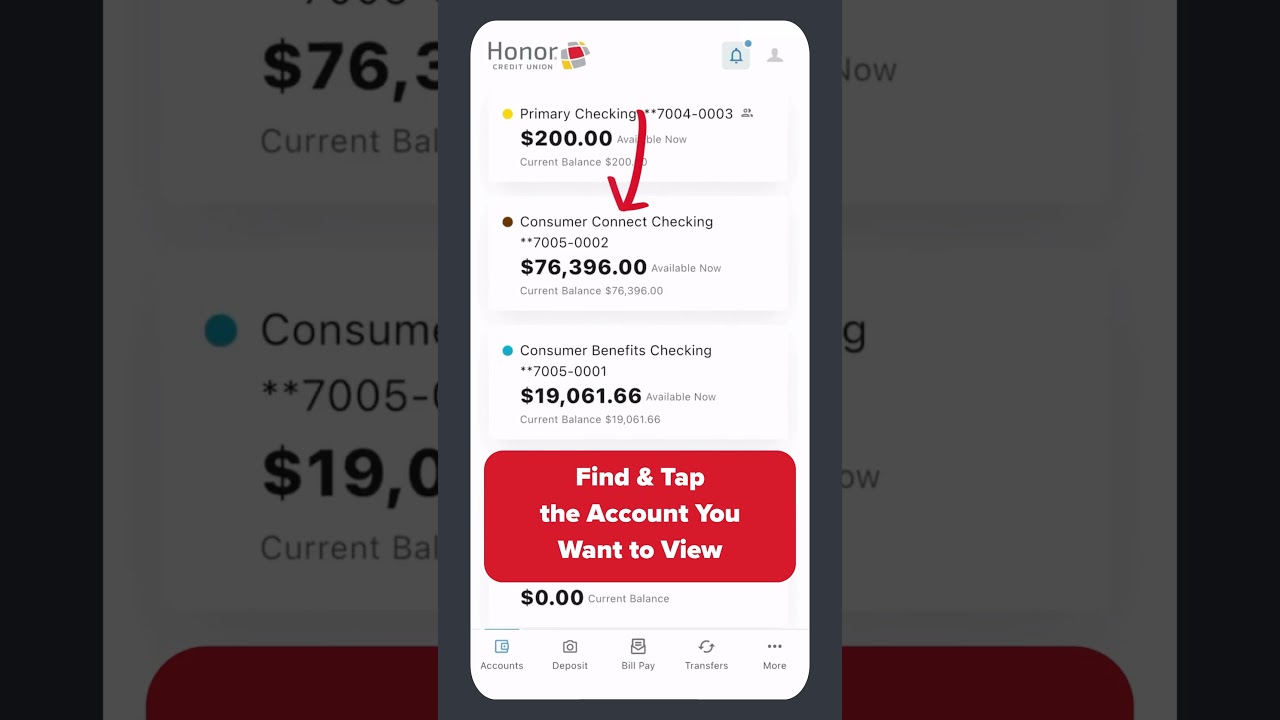

Manage Your Account Online

- Review the balance of your checking, savings, money market, certificate of deposit, and loan accounts.

- Transfer funds between your accounts, and to other members.

- Download account details to Intuit Quicken.

- Set alerts for when automatic deposits or withdrawals are processed by clicking the eAlerts Subscriptions within online banking.

Honor App + Online Banking: How-To Guides

Mortgage Testimonials

0:44

0:24

0:54

0:46

0:17

1:39

2:01

Mobile Check Deposit

The days of driving to a branch or ATM to deposit your checks are over! Mobile Deposit lets you deposit checks into your account using your smartphone or tablet, simply by snapping a picture! Using mobile deposit through the Honor app let’s you access your funds within minutes!

How to Make a Free Mobile Deposit

- Open the Honor app

- Tap Mobile Deposit

- Follow the prompts on the screen

- Enrolling in Mobile Deposit is free

Manage My Cards

With the Manage My Cards feature in the Honor mobile app, you are in control of your cards and the activity on your cards. From the ability to turn your cards on and off, receiving real-time transaction alerts, to redeeming credit card reward points and viewing spending insights, Manage My Cards is a feature worth using!

Real-Time Alerts

Receive real-time mobile app alerts or email notifications every time your card is used.

Reset Your Pin

Within Manage My Cards, you can easily reset your pin to keep your account safe and secure.

Turn Cards On/Off

You’re in control! Quickly and easily immediately turn your card(s) on/off with just the swipe of your finger.

Manage Travel Plans

If you’re travelling out of state or internationally, notify us within Manage My Cards to make sure your card(s) are not restricted during your trip.

Redeem Reward Points

Members with reward-eligible credit and debit cards can redeem reward points without the need to enter separate username/password.

View Spending Insights

Develop healthier spending habits or simply keep track of card usage by quickly seeing how, when and where you spend.

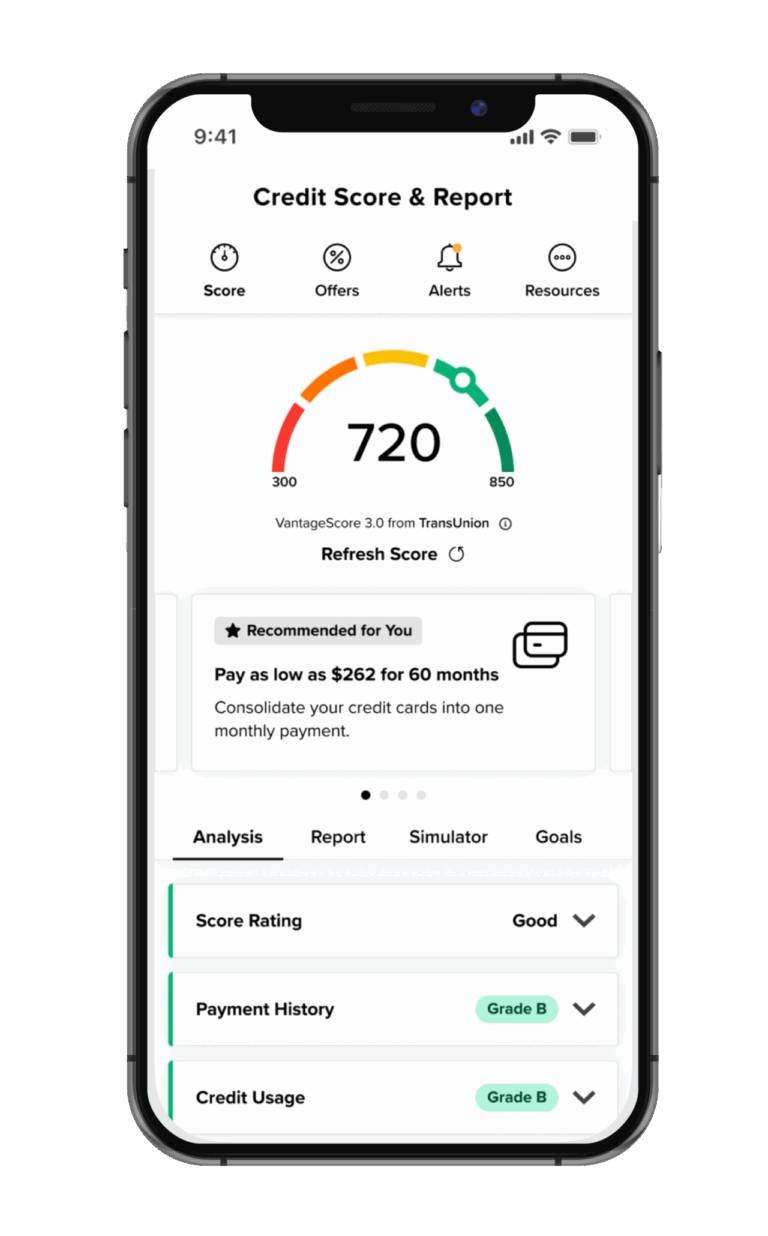

Check Your Credit Score

We offer our members the chance to view their credit score for free online with SavvyMoney. Scores are updated once every quarter, meaning any new credit activity or credit pulls won’t be reflected in your score in your online account until the next quarter.

Pay Anyone

If you have a bill payment due, or if you owe a friend some money you can now send money using the Honor mobile app using Pay Anyone!* It doesn’t matter if it’s a business or an individual. The best part is that enrolling and using the Pay Anyone is FREE!

How to Pay Anyone

Sending a payment to anyone is simple using the Honor mobile app. Simply follow these four steps:

- Open the Honor app

- Tap Move Money from the bottom menu

- Tap Pay Anyone

- Follow the prompts on the screen

eStatements

Switching to eStatements means less paper and more convenience. You can access your statements anytime you log in, stay organized with past records, and feel confident knowing your information is stored securely.

Advantages of eStatements

Faster access – Get your statement as soon as it’s ready, no waiting for the mail.

Eco-friendly – Reduce paper waste and help the environment.

More secure – Delivered securely within online banking, not left in the mailbox.

Easy to store – Download and save statements for your records anytime.

Anytime, anywhere – View past and current statements right from your phone, tablet, or computer.

Free and convenient – No extra cost, no clutter, just simple banking.

View eStatements directly in online banking by clicking here.

Online Bill Pay

*For security purposes, members are automatically unenrolled from Bill Pay if you have not used the service within 90 days of enrolling, or 12 months of inactivity. You can re-enroll for free at anytime.

Features

Save time – Pay all your bills in one secure place, no more writing checks or mailing envelopes.

Stay organized – Track due dates and payment history without the paper clutter.

Avoid late fees – Set up automatic or scheduled payments so you never miss a due date.

Bank on your schedule – Pay bills anytime, anywhere, from your computer or phone.

Safe and secure – Payments are processed through encrypted, trusted systems.

It’s free – No extra charges for convenience.

Digital Wallet

Shopping has never been easier with solutions like Apple Pay™, Google Pay™, and Samsung Pay™. There’s no reason to lug around a thick wallet or big purse with credit cards and debit cards. Simplify your life by making your purchases with the touch of your finger by connecting your Honor debit and credit cards to your phone today.

Apple Pay allows you to use your eligible iPhone, Apple Watch, or iPad at participating merchant locations nationwide to conveniently make purchases, all without reaching for your wallet.

Google Pay is easy, secure and private. Android users can now make purchases with your phone at more than one million stores across the United States.

Samsung Pay is a simple, secure mobile payment system that allows users to earn reward points with every purchase that can be used on instant games, gift cards, or Samsung products.