Live Updates: Online & Mobile Banking Access

Our digital upgrade has everyone excited, and we’re experiencing higher-than-normal traffic. Our team is on it and working hard to assist every member.

Bank On The Go

Ensure your phone’s operating system meets current requirements and is up to date.

- iPhone: iOS 15.0 or higher

- Android: 15.0 or higher

Note: Some older phones (iPhone X and older; Google Pixel 3a series, Samsung Galaxy S10 series, OnePlus 7 series) have officially reached end-of-life for security updates, meaning they no longer receive the patches that keep your information safe. Because your security is our top priority, we can’t support devices that are no longer protected.

If you are logging in for the first time you may have to delete and reinstall the app.

Quick Upgrade Answers

Can I get an early access to my direct deposit?

- We’re working on getting this feature up and running, making ongoing improvements to deliver the best possible experience.

Can I check the status of my qualified dividends?

- Yes, you can check the status of your Qualified Dividend Status by clicking into your Accounts Tab > Qualified Dividends Status. From here it will populate your current dividends status.

Historical Transfers between Honor accounts

- Any internal transfers completed between two Honor accounts on 10/16/25 or prior will appear in your transaction history as Perfect Circle Credit Union (PCCU). This will not impact your transfers and they have processed as normal.

Setting a PIN code for your account

- Select phones can use the passcode established in your phone settings to log in with a 4-digit PIN once Biometrics are turned on in the Honor app. However, a surefire way to sign in quickly would be to use fingerprint or facial recognition. Here’s how:

- Open the Honor app, go to Settings → Biometrics, and toggle it on.

- Once this is toggled on, you can use facial recognition or your fingerprint to log in without having to type in your password.

All about the upgrade: read the FAQs

Having Trouble Logging In? We Got You

Have Questions?

Frequently Asked Questions

General Information

Honor’s system upgrade enhances the tools we use to serve you. This includes improvements to our online and mobile banking applications, allowing you to make transactions and monitor your account from anywhere.

Whether you’re banking online, on your mobile device, or at one of our branches, our system upgrade ensures faster transactions, access to more services, and a smoother experience with fewer clicks.

Technology is evolving rapidly, and we want you to benefit from the latest tools in modern banking. With our upgraded systems, we can roll out new features faster, strengthen security, and make your transactions—whether by phone, online, or in person—more efficient.

Online & Mobile Banking

You can adjust your device setting to make text easier to view.

- Open the Settings app on the device.

- Go to Accessibility.

- Select Display & Text Size (or just Display on some devices).

- From there, options such as Bold Text, Larger Text, and Increase Contrast can help make the text in the app easier to read.

Yes, you can reorder the layout of your accounts, color code, nickname and more!

Online Banking

- Login to your online banking.

- Click your profile icon in the upper right hand corner > Click Settings.

- Click the Accounts Tab.

- Above each category (.ie. checking, savings, etc.) you can click “Reorder Accounts” and drag and save in the order you would like to see them listed.

Pro Tip: You can additionally click the pencil icon to create a new nickname, change the color code, or unhide/hide the account from view.

Honor Mobile App

- Login to your mobile app

- Click your profile icon in the upper right hand corner > Click Settings

- Click Accounts > Click the account in which you would like to change the color of, nickname, or choose to hide from view.

Pro Tip: While you cannot reorder your accounts from within the mobile app, you can do so through Online Banking (desktop view).

Yes, following our system upgrade, members who use third-party apps or software to integrate with their Honor Credit Union accounts (such as budgeting tools or financial aggregators) will need to reestablish those connections. This helps to ensure continued secure access and functionality.

To reconnect these apps, please log into your third-party apps and follow their instructions to reconnect your Honor Credit Union account, using your updated login credentials.

Yes, the upgraded design is built to enhance your overall experience. It offers improved functionality along with a more intuitive, user-friendly layout, making it easier than ever to manage your accounts with confidence.

You will need to ensure you have the latest version of the Honor mobile app installed. We recommend checking the App Store to make sure you have the latest version installed, so you can enjoy all the new features and improvements without interruption. If you are still seeing the old app, try deleting it and reinstalling it to alleviate any login issues.

Yes! Each individual user will have their own login. That means, no more sharing login credentials for the same account. Plus, multi-factor authentication (MFA) will be automatically enabled to help keep your account secure.

You will need to log in to your personal account using our new online and mobile banking system. Your first login may prompt a password reset for security.

Yes! Each individual user will have their own login. That means, no more sharing login credentials for the same account. Plus, multi-factor authentication (MFA) will be automatically enabled to help keep your account secure.

The primary owner is the first name listed on your account statement and is the name associated with the account in online banking. If you’re unsure, we encourage you to contact Honor before the upgrade—we’re happy to help ensure everything is set up correctly.

- Multiple Primary Accounts – If you have more than one primary account, only one username will transfer to the new system. This will be the account you logged into most recently. If recent logins are too close together, we will transfer the account with the shortest account number.

No problem! Once you enter either your username or Company ID, you will have the option to click “Forgot Username / Password”. From there, you will be prompted to verify your identity and create your new credentials.

Account Information

Your account/member number will remain the same. You may notice a few extra zeros at the beginning of your number; this is just for system compatibility. Your suffixes will also be four (4) digits rather than three (3) digits. For example, account 123456–001 will become 0000123456–0001. These additional numbers will not need to be used when logging into online banking or setting up bill payments.

You’ll continue to have access to up to 24 months of statement history through online banking, so you can easily find what you need whenever you need it.

Yes, your statements may have a refreshed appearance following the upgrade. However, there’s no action required on your part, they’ll continue to be delivered just as before.

If you’re already enrolled in eStatements, there’s no action needed. Your electronic statements will continue without interruption.

Cards, Payments, and Transfers

Your UChoose Rewards points will remain unaffected by the upgrade. You’ll continue earning and redeeming points just as you do today, with no changes to your current rewards program.

After October 14, you’ll just need to re-enroll in UChoose Rewards at www.uchooserewards.com to continue enjoying all the benefits.

Your current checks will continue to clear without issue after the upgrade. Any new checks you order moving forward will reflect your updated account number, helping ensure everything stays accurate and up to date.

- Checks: Your checking account number is the middle set of numbers printed on your checks, excluding the last digit.

- Membership Card: Your membership card is the card you received when you first opened your Honor account.

- eStatements: Your account number is listed at the top right corner of your eStatements.

- Account Details in Online Banking: Log in and click “Account Details” and select the account you wish to view the full account number for. Under the title of the account, click the eye icon to view your full account number.

For security reasons, full account numbers are not shown on statements. If you’re unsure or need help locating it, our team is happy to assist you.

No, you only need your account/member number to log in for the first time, preceding zeros (0) and suffixes are not required. Suffixes can be identified by the last three (3) digits following your account/member number (checking – 001; savings – 000.)

Your debit and credit card details—including your PINs—will stay the same. You can continue using your cards just as you do today, with no changes to your card numbers or security codes. It’s one less thing to worry about as we upgrade your banking experience to be even more seamless and secure.

Your scheduled bill payments and transfers will continue to process as usual—no action needed on your part. We recommend taking a moment to review them to make sure everything was transferred correctly.

Your direct deposit details will carry over smoothly to the upgraded system, no changes required. We recommend taking a moment to double-check that your deposit(s) went through as expected.

Your automatic payments—like subscriptions, utilities, or loan payments should resume as scheduled. As a best practice, we recommend double-checking that everything posts correctly.

Our current fee structure will remain the same. If any updates happen in the future, we will always communicate this ahead of time, so you’re always informed and never caught off guard.

Fraud and Safety

Mastercard is able to help with several fraud-related concerns, including:

- Freezing your account if fraud is suspected

- Clearing fraud alerts that appear on your phone

- Verifying whether specific charges are fraudulent

- Activating your card

- Utilizing Digital Wallet Tokens

- Resetting your PIN

If you notice any suspicious activity, we recommend contacting our Fraud Line directly at 800.992.3808 for fast and secure support.

Frequently Asked Questions: Business

Direct Deposits & Transfers

Direct deposits, scheduled transfers, and automatic payments set up within the primary account holder’s profile will carry over automatically; no action needed.

We recommend reviewing and confirming that all payments are set up correctly.

Your employees’ direct deposit information will transition smoothly to the new system—no updates needed. We recommend taking a moment to double-check that they are correctly processed.

Bill Pay

Most scheduled Bill Pay payments will carry over to the new system. However, any payments set up by a secondary user (not the primary account holder) will not transfer and will need to be re-entered after October 14. In addition, external transfers and account to account (A2A) transfers will not transition and will need to be manually recreated by the primary user.

Yes—you can easily download or print reports from your Bill Pay account to keep track of your payment activity. Just head to the “Reports” section, choose the report type and date range, and generate the report to view and export it.

You can also create reports for Payment Changes, Payments Stopped, and Payees Added, giving you a full picture of your Bill Pay history.

Check payments made through business Bill Pay will be withdrawn from your account once the recipient deposits the check.

This means your account won’t be debited until the funds leave, similar to how traditional checks work.

Currently, your account is debited the day after you submit a payment, even though the check may not be cashed for several days. The new process gives you more accurate visibility into your account activity and better control over your cash flow.

Yes, you can still request a Stop Payment. This option remains available for checks, ACH transactions, and Bill Pay payments, giving you continued flexibility and control over your accounts.

Online & Mobile Banking

To avoid duplicate accounts appearing in your online banking profile, we recommend deactivating your existing connection before registering the new one. Taking this quick step will help ensure a clean transition and a smoother experience in the upgraded system.

Yes—you’ll continue to have access to your transactions in Quicken and QuickBooks.

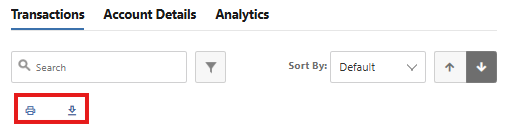

- Login to your online banking. While on the Dashboard, you can preview your accounts and balances. To view detailed information about a specific account, select the account from this list.

- After selecting an account, you will be directed to the Accounts tab (also accessible by hovering over Accounts > select Account Details) where you can view transactions, account details, and account analytics.

- On the Transactions tab you can download your transaction history.

Download options include:

- Download Format (Formats available: CSV- comma separated values, OFX- Open Financial Exchange, QFX- Quicken WebConect, QBO-QuickBooks)

- Start Date

- End Date

- Select Accounts

Once the appropriate information is input/selected, click the Download button.

Please Note: If a transaction does not populate with a general search, the advanced search function can be used to search by specific criteria (dollar amount is recommended).

We’re introducing a new Snapshot feature that gives you a quick, convenient view of your balance and other key account details—no login required. It’s a fresh take on text banking, designed to keep you connected and informed at a glance.

You can find helpful resources at Quicken and QuickBooks User Information | Honor Credit Union.

Yes, you have the option to conveniently manage both your business and personal accounts using one app and login.

To activate this login grouping feature, contact Honor Credit Union at 800.442.2800 or email upgrade2025@honorcu.com—our team is ready to help get you set up.

Logging in is simple! If you previously accessed your business account using a username, you’ll continue using that same username. If you logged in with a Company ID/Employee ID, you’ll now use just your Company ID after the upgrade.

You’ll be prompted to create a new password. Start by entering your username and current password—the system will recognize your credentials and guide you through the reset process. You can also use the “Forgot Password” option if needed.

As part of the login, you’ll complete Multi-Factor Authentication (MFA) to verify your identity and keep your account secure. Once logged in, the primary account holder can easily add sub-users and assign permissions as needed.

Yes, after logging in, the primary account holder can add sub-users to the business account and assign custom permissions based on their roles. Each sub-user will then create their own unique username and password for secure access.

If you currently use the Honor Credit Union Business Mobile Banking App, please note that it will no longer be supported after October 14. Moving forward, all members—both personal and business—will use the Honor Credit Union Mobile Banking App.

- If you already use the regular Honor Credit Union app for personal banking, You’re all set! Be sure to check the app store to ensure your app is up to date.

- If you don’t have the regular app yet, you’ll need to download it from the App Store or Google Play Store to continue managing your business accounts from your mobile device.