Resource provided by Savvymoney Article

Author: Jean Chatzky with reporting by Casandra Andrews

Discover practical tips to stay on track financially and avoid accumulating high-interest debt.

Do one thing: If you don’t have one already, set up a separate checking or savings account and designate it as your emergency fund. Move money into the account every time you get paid.

Avoid Overspending with These Strategies

Sometimes, when the going gets tough, even the toughest among us go shopping. Buying something we want can trigger feel-good endorphins, but too many splurges can lead to living above your means — and ultimately high‑interest credit card debt.

Carrying Debt Month to Month?

Research shows that about half of Americans with credit cards carry debt from month to month because they can’t afford to pay off balances in full. If that’s you, take heart.

There is Hope. The good news: there are strategies to avoid high‑interest debt, save money, and reduce the stress of living under bills.

SavvyMoney Tip: Many of these same strategies can also help you dig yourself out of debt.

Consider these practical expert tips to help you avoid falling into high‑interest debt.

1. Create a Spending Plan (or Budget)

Knowing where your money goes each month is key. Financial planners recommend creating a spending plan based on your goals. Include:

- Your monthly bills

- Regular expenses

- Long-term savings

- Irregular-but-expected expenses (electronics, repairs, travel)

“If you choose to take on more debt,” Mockford says, “confirm through your budget that you can make space for this new monthly bill.”

2. Build an Emergency Fund

Eric Roberge, CFP, recommends keeping an emergency fund of 3–6 months of expenses in a separate account.

Separate Account

“Out of sight, out of mind,” he explains — keeping emergency savings separate helps prevent spending it and protects you from needing debt during unexpected events.

3. Learn to Live Below Your Means

Living below your means is a proven strategy to stay debt‑free and save more. Examples include:

- Rent or buy a smaller home than you can afford

- Buy used vehicles instead of new

- Shop sales instead of paying full price

- Save raises by increasing retirement contributions

- Use a library card for free books and streaming

4. In a Word: Unsubscribe

Avoid temptation by removing retail promotional emails. If you’re getting emails from retailers, hotels, or subscription clubs, it’s time to:

- Scroll to the bottom of the email

- Click “unsubscribe”

- Do not resubscribe later

You can’t buy what you don’t see. Your wallet will thank you.

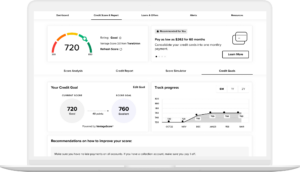

Get started with Savvymoney to jumpstart your goals! Log into your Honor App or online banking today.