financial tips

There is a lot to know about finances. That’s why we have dedicated blogs about managing your finances, covering robust financial tools, ways to manage debt, and how to navigate milestone purchases.

Free Money Guidance Through GreenPath

GreenPath Financial Wellness provides free financial counseling, debt-management support, and credit-building guidance to help you strengthen your financial health.

Get free, confidential guidance from our partners at GreenPath

Build a budget that actually works for your life

Tackle credit-card or student-loan debt with expert support

Get a free credit-report review and tips to boost your score

Learn at your own pace with LearningLab+ videos and tools

Explore debt-management plans that simplify payments and cut stress

Access helpful webinars, calculators, and resources to reach your goals

Overdraft Protection

An overdraft occurs when you do not have enough available funds in your checking account to cover a transaction. We understand life happens, and everyone can sometimes make a mistake or encounter financial challenges, so we have overdraft protection options to assist you in these situations.

Overdraft Options

- You can set up automatic transfers from another account, such as a savings account or money market, to cover your overdraft.

- Learn how Courtesy Pay could help cover an overdraft if you do not have an automatic transfer set up.

- Learn how an NSF (Non-Sufficient Funds) might occur when you don’t have an automatic transfer or Courtesy Pay set up.

Financial Calculators

It’s important to know how much house, car, truck, boat or other vehicle or project you can afford. Likewise, when you’re saving money you want to know what solution is going to earn you the most interest and be the best fit for your needs.

Money & loan calculators

Home & Mortgage: See your monthly payment, explore payoff or refinance options, and check how much home equity you might unlock.

Auto & RV Loan: Estimate your car or recreational vehicle payment and see how much faster you can pay off your loan.

Savings & Earnings: Compare how your money can grow in savings, CDs, Money Market, or Benefits Checking.

Business Tools: Estimate how much your business can earn with Accelerate Business Checking.

Financial Tips & Advice

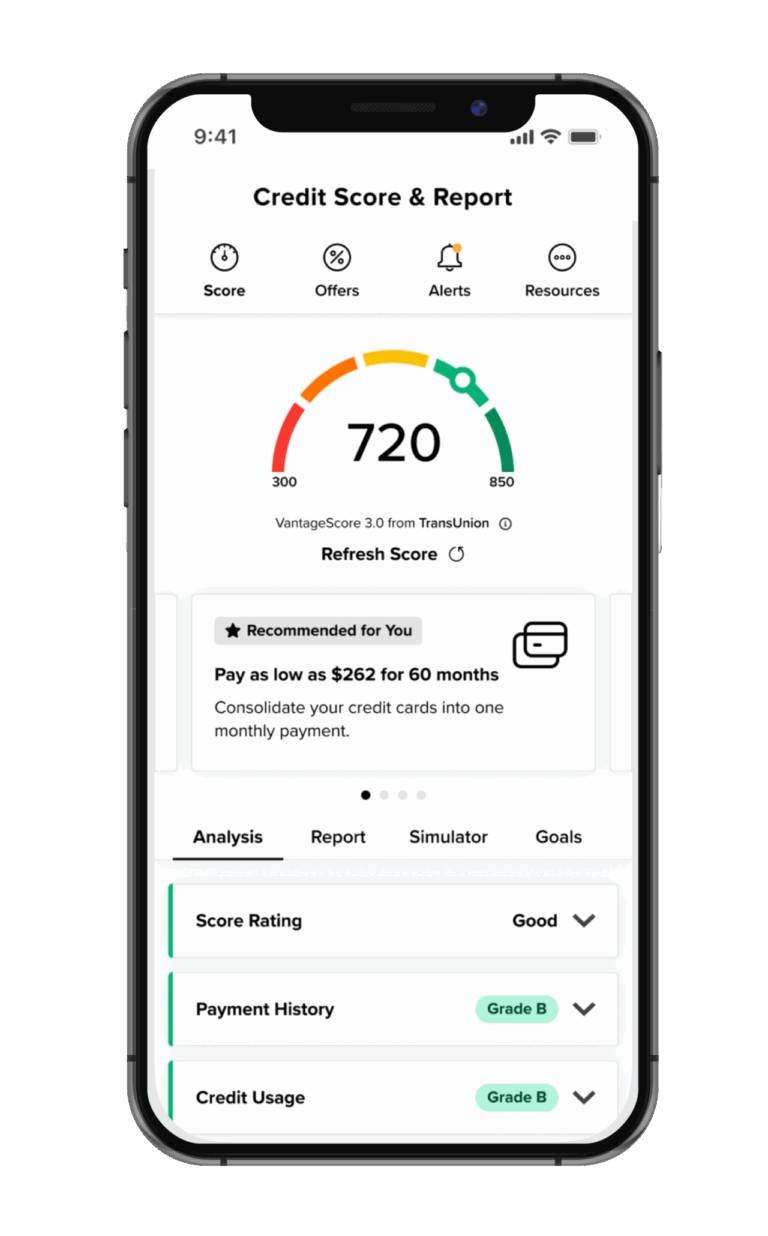

Check Your Credit Score

We offer our members the chance to view their credit score for free online with SavvyMoney. Scores are updated once every quarter, meaning any new credit activity or credit pulls won’t be reflected in your score in your online account until the next quarter.