Logging In

Ensure your phone’s operating system meets current requirements and is up to date if you are using the Honor mobile app.

- iPhone: iOS 15.0 or higher

- Android: 12.0 or higher

Choose Your Account Type

Let’s get you started! Pick the option that matches your account, and we’ll guide you through logging in.

Please note: You will need to type in your username (do not use autofill).

Description: You have one primary account. The primary account holder is the person listed on the statement, or the name visible in the existing online/mobile banking platform.

Username: Use the same username as you use today

Password: You can enter your existing password and be prompted to update OR you can click "Forgot Password" and reset a new password.

Notes: You will be asked to authenticate your account. If you also have a business account, then please see instructions on how to log in for your business account.

Description: You have more than one primary account.

Username: Use the same username of your most recent log in.

Password: You can enter your existing password and be prompted to update OR you can click "Forgot Password" and reset a new password.

Notes: If you have multiple accounts, you will no longer need multiple usernames and logins! Therefore, only one primary account will be brought over to the banking platform - which is the account you most recently logged into. If you don’t have a recent login, we will set your username to the username associated with your smallest account number. We are sorry for any confusion this causes but we are ready to help you figure it out, just visit a branch location or call our Contact Center with your questions.

Description: You are a joint member and do not have a primary account.

Username: You will need to enroll as a new user after the upgrade. Click "Register a New Account" within online or mobile banking.

Password: You will create a password when you enroll as a new user.

Notes: After the upgrade joint owners will be able to register and have your own access with your own unique username and password. No more sharing credentials!

Description: You are the primary business member

Username: If you previously logged in to your business account with a username, you'll continue using the same username. However, if you previously logged in using a Company ID and Employee ID, then you will log in using just your Company ID after the upgrade. If you previously have not used the business banking platform, then you will need to create a new user.

Password: You can enter your existing password and be prompted to update OR you can click "Forgot Password" and reset a new password.

Notes: Only the primary business member will be brought over to the new banking platform. Once the primary business member logs in they can add sub-users and set permissions for each sub-user. Please note: ALL business accounts will now be on the business banking platform. Once logged in you can connect your personal account with your business account.

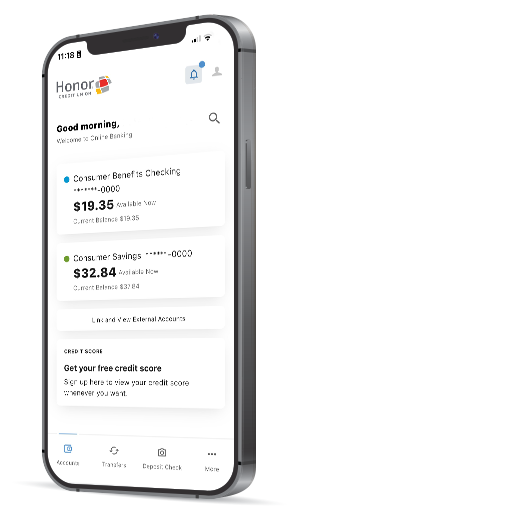

Step by Step Instructions

Here’s a quick walkthrough. Start with Step 1 and we’ll show you exactly what to do next.

Note: you may have to delete and reinstall the app.

Enter your credentials and click "Log In" button. Please note, you will need to type in your username (do not use autofill).

Click on create a new password

Choose "Reset my password"

Fill in the required fields

Choose a password reset method

Enter your code

Choose your new password.